By Jeremiah D. Wood

The American Rescue Plan Act of 2021 (ARPA) was signed by President Biden on March 11, 2021. The ARPA follows previous laws applicable to the minimum funding contribution requirements for defined benefit plans, and this article discusses the impacts of the ARPA on Single Employer Plans (as opposed to Multi-Employer Plans).

Single Employer Defined Benefit Plans (Single Employer DB Plans) use interest rates specified by the Internal Revenue Code to convert future benefits into the present value of such benefit expressed as a lump sum amount. This lump sum amount is compared to the assets in the plan to determine if there is a minimum funding contribution required.

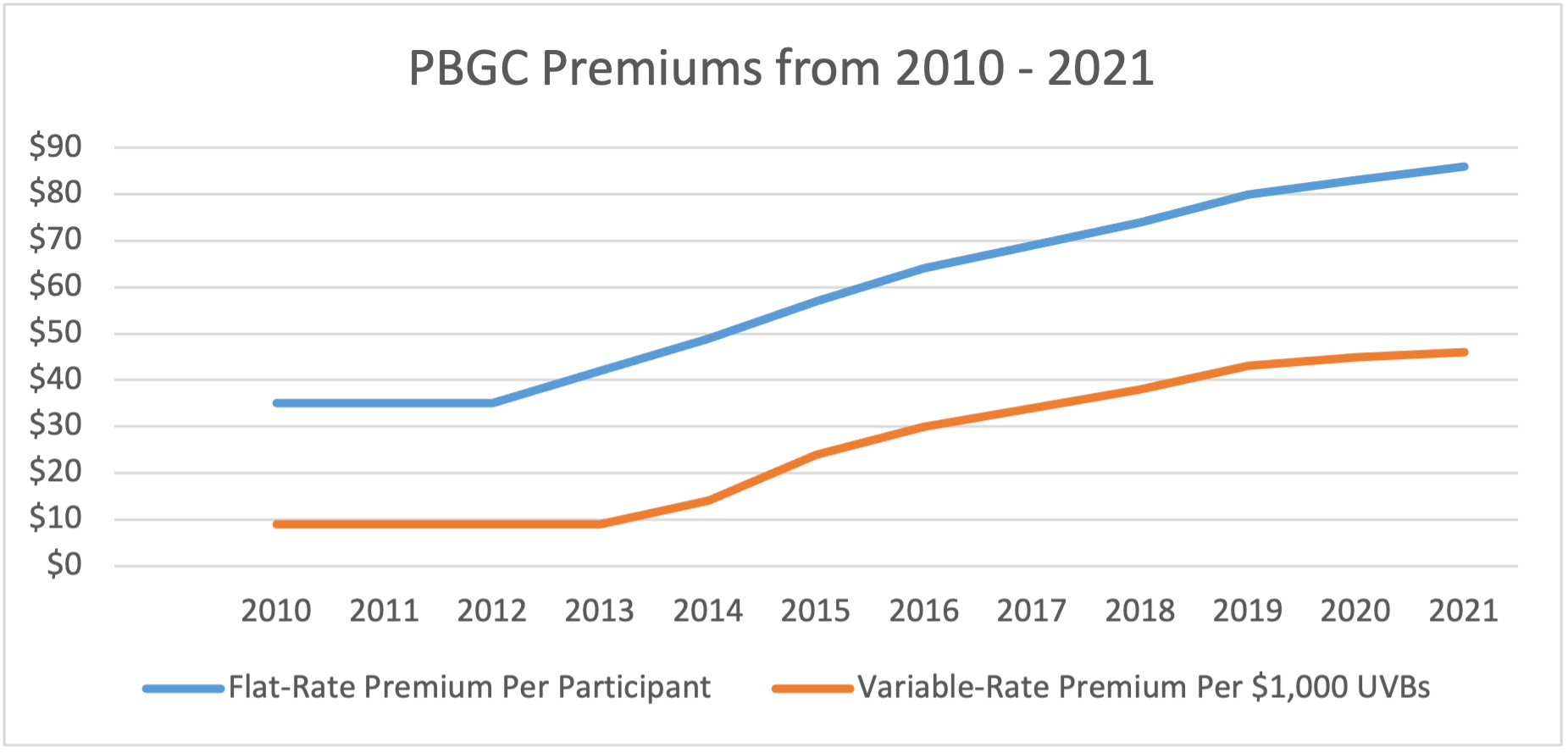

In recent years, Single Employer DB Plans have been hit by larger than normal minimum funding contribution requirement due to the decrease in the interest rates used to calculate minimum contributions. This is despite Congress passing laws to assist with the historically low interest rates applicable for calculating minimum contributions. To make matters worse, there has been a steep rise in the premiums due to the Pension Benefit Guaranty Company (PBGC) over the same period.

Extension of Stabilization Rules Applicable to Interest Rates

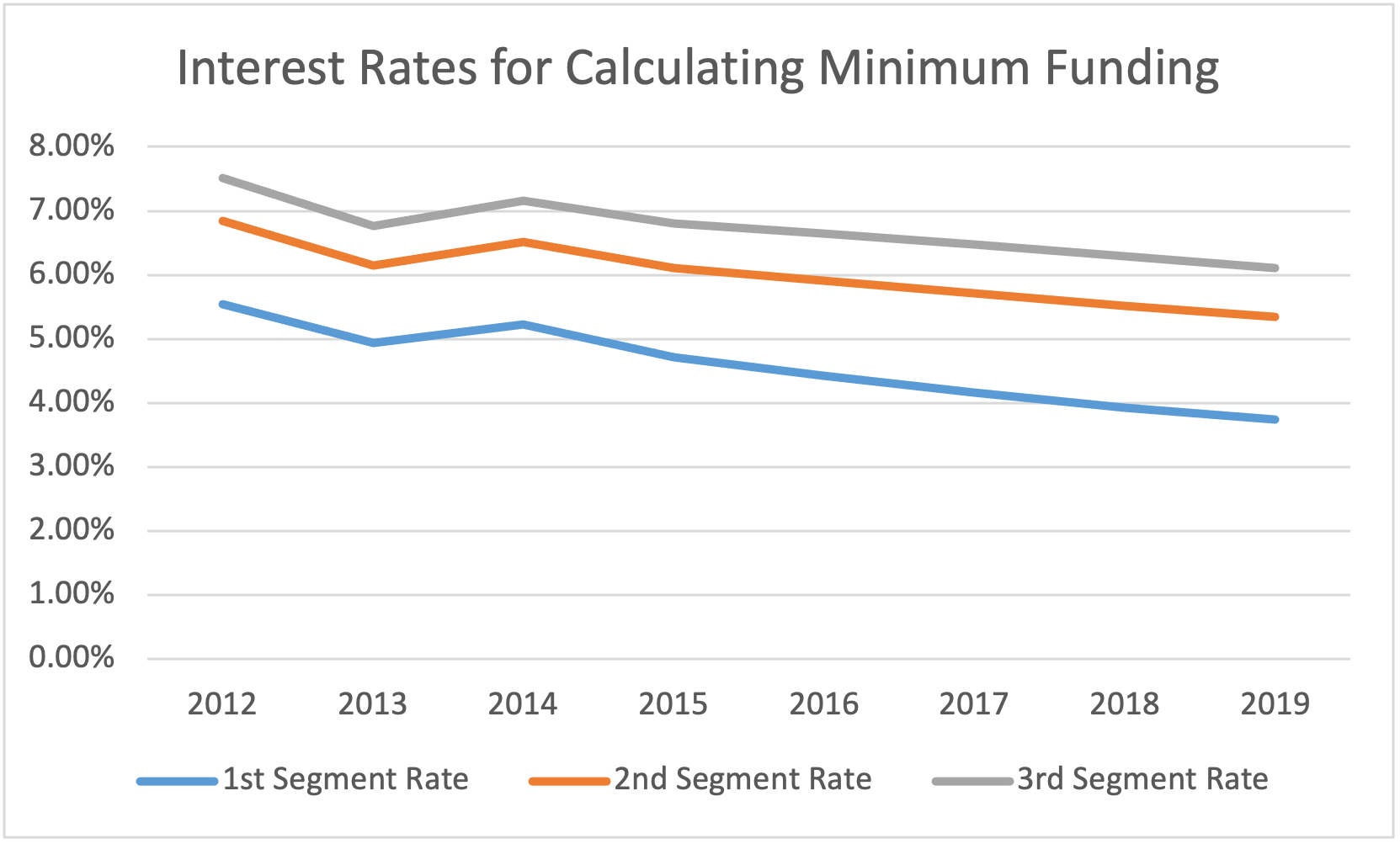

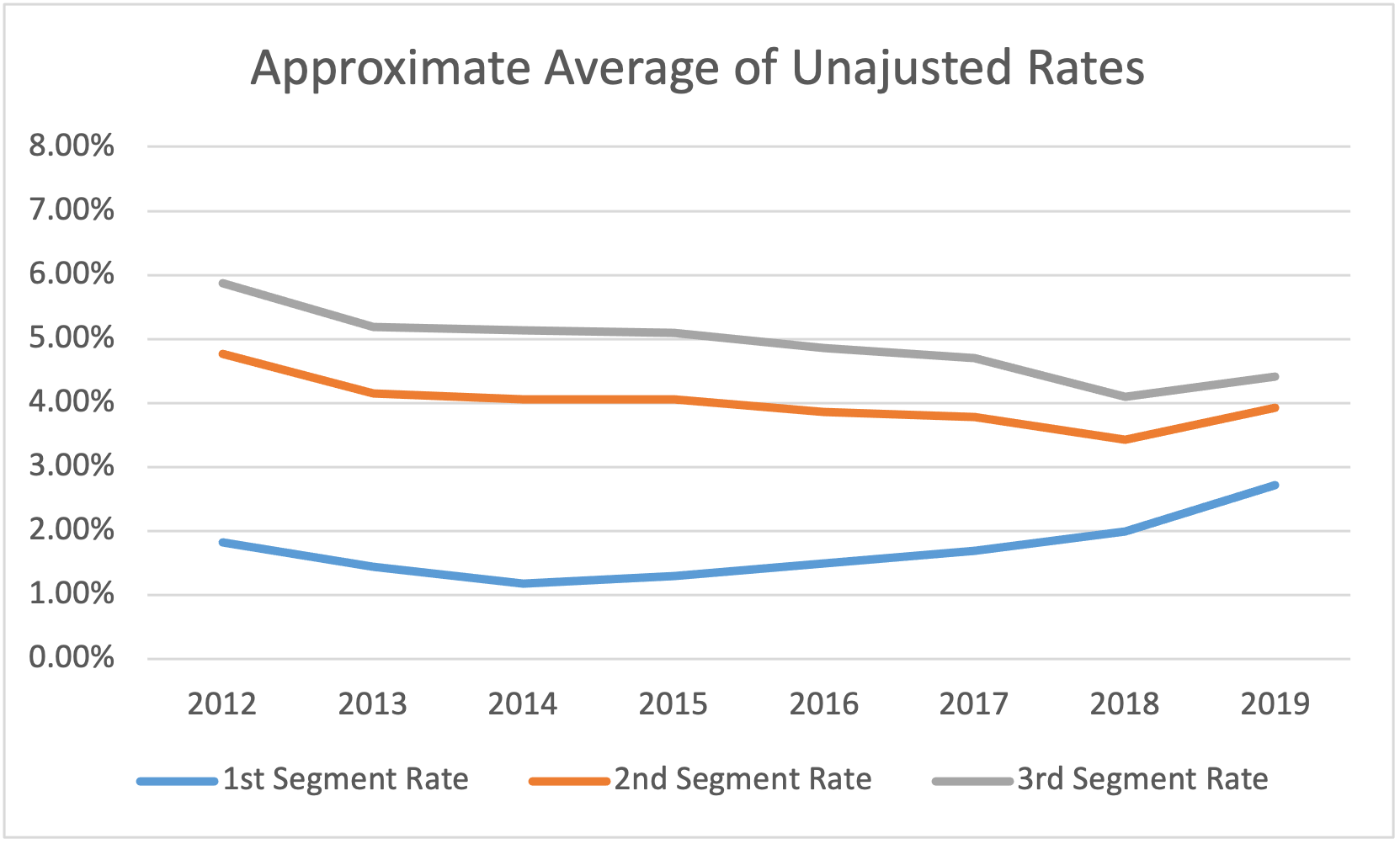

The interest rates used to calculate the minimum funding contribution requirements are generally based on three yield curve segment rates (each one is applied depending on how soon the payments are expected to be made from the Plan). Without getting too detailed, these yield curve segment rates are generally determined by taking a 24-month average of the monthly corporate bond yield curves for investment grade corporate bonds. Congress has tried over the years to assist with the historically low interest rate environment, thus for plan years beginning on or after Jan. 1, 2012, the segment rates used for a particular year had a maximum and a minimum based on a 25-year average of such rates. This change is sometimes referred to as the segment rate stabilization rules or using MAP-21 rates. Due to the low interest rates for the past eight years, the minimums in the segment rate stabilization rules are effectively the interest rates that apply to calculate the minimum funding contribution requirements.

Despite the segment rate stabilization rules, the applicable interest rates for calculating the required minimum funding contributions continue to fall.

See the charts below showing how these rates continue to fall and what the rates would look like if there were no segment rate stabilization.

The maximum and minimum of the stabilized segment rates were set to start expanding during 2021 and would have been fully phased out by 2024. Due to the historically low 2020 interest rate environment, this expansion would have led to larger minimum funding contributions at the same time as businesses are dealing with the effects of a global pandemic.

Under ARPA, the maximum and minimums are being narrowed and will not start expanding from this narrowing until 2026. Furthermore, to avoid having to pass future legislation to address the minimum funding contribution requirements, there is a five percent floor that applies for any year in which the applicable segment rate would be lower than five percent.

This narrowing of the stabilization rules is effective for Plan Years beginning after Dec. 31, 2019, but the plan sponsor may elect to delay application of these rules to any plan year beginning before Jan.1, 2022.

Extension of the Amortization Period for Underfunding Shortfalls

When there is an underfunding amount determined (i.e., there is a shortfall), then there is a required minimum contribution required, but the Single Employer DB Plan Sponsor is not required to fund all this shortfall in one year. The plan sponsor normally has the option to amortize the underfunding shortfall, and this amortization was over a seven-year period. ARPA expands this amortization period to fifteen years, and such expansion is permanent (i.e., it does not sunset). Additionally, any prior amounts that are still being paid off pursuant to the seven-year amortization schedule are reduced to zero and the total shortfall (including the amounts that are reduced to zero) are converted to the fifteen-year amortization period. This is similar to the underfunding amounts being refinanced for a longer period in order to reduce the payments.

This is effective for plan years beginning after Dec. 31, 2021, but the plan sponsor has the option to elect it for plan years beginning after Dec. 31, 2018, Dec. 31, 2019, or Dec. 31, 2020.

When to Apply these Changes

As noted above, the narrowing of the stabilization rules can be retroactive to plan years beginning in 2020 and the extended amortization period can be retroactive to plan years beginning in 2019. Even though the valuations for some of these years have already been completed, it may be valuable to revisit those valuations to take advantage of the changes in ARPA.

Plan sponsors also have the option to delay the effective date of the ARPA changes until 2022. Thus, there will need to be an election form related to the effective date of these changes.

Thoughts on PBGC Premiums

As mentioned above, the PBGC Premiums for Single Employer DB Plan Sponsors have gone up considerably during the same time that they have been faced with these historically low interest rates. The ARPA did not make any changes to the PBGC premiums of which there are two separate calculations to determine these premiums. The first premium, the flat-rate premium, is based on the number of participants in the Plan times a dollar amount ($86 in 2021), and the second premium, the variable-rate premium, is based on the amount of the underfunding liability (i.e., the shortfall) per $1,000 times a dollar amount ($46 in 2021). Below is a chart reflecting the rise in the dollar amounts used to calculate these two premiums over the last 11 years.

While the ARPA changes are welcomed relief for Single Employer DB Plan Sponsors, it will be important for plan sponsors to remember that lower contributions will increase PBGC premiums because the Variable-Rate Premium is based off of underfunded benefits. Unfortunately, this may make avoiding PBGC premiums the primary focus of funding decisions instead of the financial health of the sponsor’s plan and company.

If you would like to discuss how the ARPA might affect your Single Employer DB Plan, please contact one of the attorneys at Friday, Eldredge & Clark, LLP.

Jeremiah D. Wood practices in the firm’s Employee Benefits and Executive Compensation Practice Group. His practice includes experience in the design, implementation, administration and termination of tax-qualified retirement plans (including traditional pension plans, cash balance plans, profit-sharing plans, 401(k) plans, and ESOPs), 403(b) plans, nonqualified deferred compensation plans (including 457(b) and 457(f) plans and deferral compensation arrangements for executives) and health and welfare plans.

Disclaimer: The information included here is provided for general informational purposes only and should not be a substitute for legal advice nor is it intended to be a substitute for legal counsel. For more information or if you have further questions, please contact one of our Attorneys.