By Jeremiah D. Wood

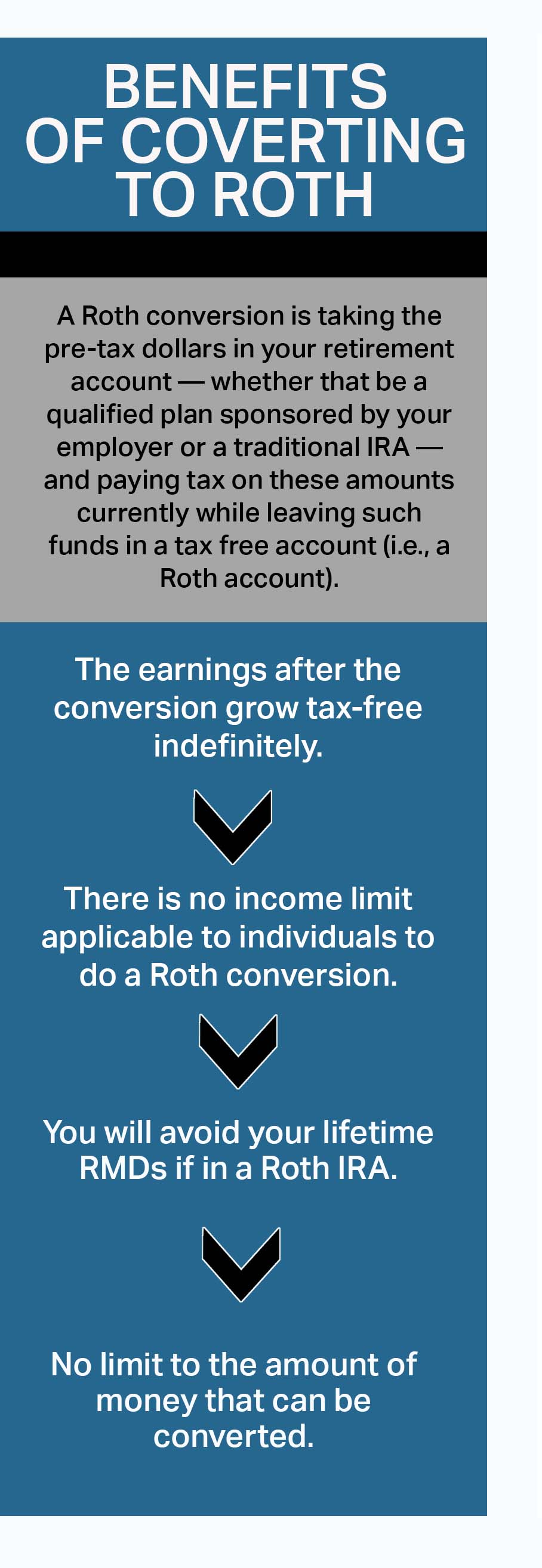

During the COVID-19 pandemic, the investment world has seen a dramatic decrease in values. This is obviously not what you want to see in your retirement account; however, there could be a silver lining for you to take advantage of — a Roth conversion. A Roth conversion is taking the pre-tax dollars in your retirement account — whether that be a qualified plan sponsored by your employer or a traditional IRA — and paying tax on these amounts currently while leaving such funds in a tax free account (i.e., a Roth account). The earnings after the conversion grow tax-free indefinitely, so when you pull the funds out of the Roth account, there is no tax. Although, the distribution from the Roth account must be a “qualified distribution” to be tax free. This requires that the Roth distribution is made after a 5-year period of participation in the Roth account and occurs on or after the individual attains age 59 ½. In the case of a Roth conversion, the 5-year period begins on the date of the Roth conversion. If there is a distribution from a Roth account that is not a qualified distribution, then the earnings in the Roth account from the time of the Roth conversion will be taxed.

There is no income limit applicable to individuals to do a Roth conversion and no limit on the amount of money that can be converted. In order to make an in-plan Roth conversion, the qualified plan must allow for Roth contributions and allow for the Roth conversion within the plan. Alternatively, if the qualified plan allows for in-service distributions (i.e., a distribution while you are still working for the employer sponsoring the plan), then you could do a Roth conversion by rolling over the pre-tax funds from the qualified plan into a Roth IRA, and if you are no longer working for such employer, then you simply take a distribution from the qualified plan and roll it into a Roth IRA.

The biggest drawback to making a Roth conversion is, obviously, paying the tax. If you do not have funds outside of the retirement account to pay the tax, then it generally does not make sense financially to do the Roth conversion. During the current market and with the current tax rates, it may be a good time for a Roth conversion. The main two considerations when contemplating a Roth conversion are 1) the tax rate you pay now compared to what tax rate you (or your beneficiaries) will pay on the funds withdrawn in the future and 2) the value of your assets in the retirement account.

It is impossible to know what the future tax rates will be, but considering that the tax rates are currently near the lowest levels in 30 years and the potential change in administration in Washington D.C., the current rates are attractive for a Roth conversion. Additionally, a recent change in the law related to the required minimum distribution rules prevents your non-spousal beneficiaries from stretching the retirement benefits over the life of your beneficiaries. This means that the tax deferral is not as great as it once was for tax-deferred retirement accounts.

Generally, the retirement benefits you leave to your heirs, excluding your spouse and other eligible designated beneficiaries[1], must be distributed (i.e., taxed) within 10 years from your death.

Furthermore, if the value of your plan investments are down significantly due to the COVID-19 pandemic, then it could be a good time to convert these investments for two reasons 1) your taxes would be based on a lower amount and 2) there may be a significant increase in the value of the retirement plan assets after the Roth conversion and such increase would be tax free if it is a qualified distribution.

Another reason that you may want to pursue a Roth conversion would be to avoid the required minimum distributions. Roth IRAs, but not Roth accounts in qualified plans, are not subject to the required minimum distributions during your lifetime. Thus, you determine how much you want to take from the Roth IRA and are not forced to take money out when you may not need or want it.

There is not bright line test to know when is the right time, if ever, to convert your pre-tax accounts into a Roth account because each situation is unique. One reason you would not want to do a Roth conversion is if you have a dependent applying for financial aid since a Roth conversion would be included in your income that is reported on the financial aid form. If you are thinking of doing a Roth conversion, but you do not want to do it all at once, then remember you do not get just one bite at the Roth conversion apple. You can do a Roth conversion each year for a number of years, and the 5-year period applicable to the qualified distribution begins from the first conversion. It is always important to talk to your tax advisor regarding your retirement accounts, and this holds true for Roth conversions.

[1] An eligible designated beneficiary is (1) the surviving spouse of the deceased account owner, (2) a minor child of the deceased account owner, (3) a beneficiary who is no more than 10 years younger than the deceased account owner, or (4) a chronically-ill or disabled individual.

Jeremiah D. Wood practices in the firm’s Employee Benefits and Executive Compensation Practice Group. His practice includes experience in the design, implementation, administration and termination of tax-qualified retirement plans (including traditional pension plans, cash balance plans, profit sharing plans, 401(k) plans, and ESOPs), 403(b) plans, nonqualified deferred compensation plans (including 457(b) and 457(f) plans and deferral compensation arrangements for executives) and health and welfare plans.

Disclaimer: The information included here is provided for general informational purposes only and should not be a substitute for legal advice nor is it intended to be a substitute for legal counsel. For more information or if you have further questions, please contact one of our Attorneys.